Version:

1.0

Updated:

12 March 2025

Downloads:

1

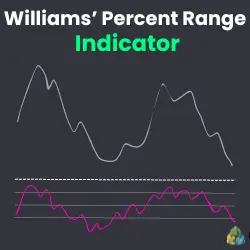

The Williams' Percent Range (Williams' %R) MetaTrader 4 is a technical analysis indicator that measures overbought and oversold market conditions. It oscillates between 0 and -100, with readings above -20 indicating overbought and below -80 signaling oversold conditions. By applying this indicator to an MT5 chart, traders can identify potential reversals, confirm market direction, and determine entry and exit points.

The Williams' %R indicator, developed by Larry Williams, is a momentum oscillator that helps traders spot market reversals and confirm trends. It compares the current closing price to the highest high over a specified period, as shown below in its formula:

- %R = -100 * [Max (High (i-n)) - Close(i)) */ {Max (High(i-n)) - Min (Low(i-n))}]

Unlike other oscillators, %R ranges in negative values between 0 and -100, with values:

- -20: indicating an overbought market condition, signaling a potential bearish reversal.

- -80: suggesting an oversold market condition, signaling a potential bullish reversal.

By downloading this indicator on a MetaTrader trading chart, traders can utilize it for various strategies, such as:

- Divergences:

- Bullish divergence: During a downtrend, when the price forms lower lows while the %R indicates higher lows, that signals a potential buying opportunity.

- Bearish divergence: During an uptrend, if the price makes higher highs but the indicator forms lower highs, that suggests a potential short opportunity.

- Trend confirmation:

- When R% crosses above -80 and moves past -50 toward -20 values, it confirms the bullish momentum signaling a long opportunity.

- When R% crosses below -20 and falls under -50 toward -80 values, it confirms the bearish movement and signals a short opportunity.

1. In the GBPUSD trading example on MetaTrader 4, the %R line drops below -50, confirming the beginning of bearish momentum. During a downtrend, traders should focus on selling opportunities and avoid buying during trend corrections. A rebound from the -80 level or a crossover below -50 signals potential sell entries.

As the trend nears its end, the indicator and the price form a bullish divergence, and when the R% line moves above the oversold zone and surpasses -50, it confirms the start of an uptrend, signaling a buying opportunity.

2. In the EURAUD trading example on MetaTrader 5, the indicator rises above -50, confirming the beginning of a bullish movement. During an uptrend, traders should focus on buying opportunities while avoiding short trades during trend corrections. A bounce off -20 values or a crossover above the -50 signals potential buy entries.

Toward the trend's end, the indicator and the price form a bearish divergence, and when the R% line moves away from the overbought zone, crossing below the -50 level, it confirms the bearish momentum, signaling a selling opportunity.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.