Version:

1.0

Updated:

05 March 2025

Downloads:

1

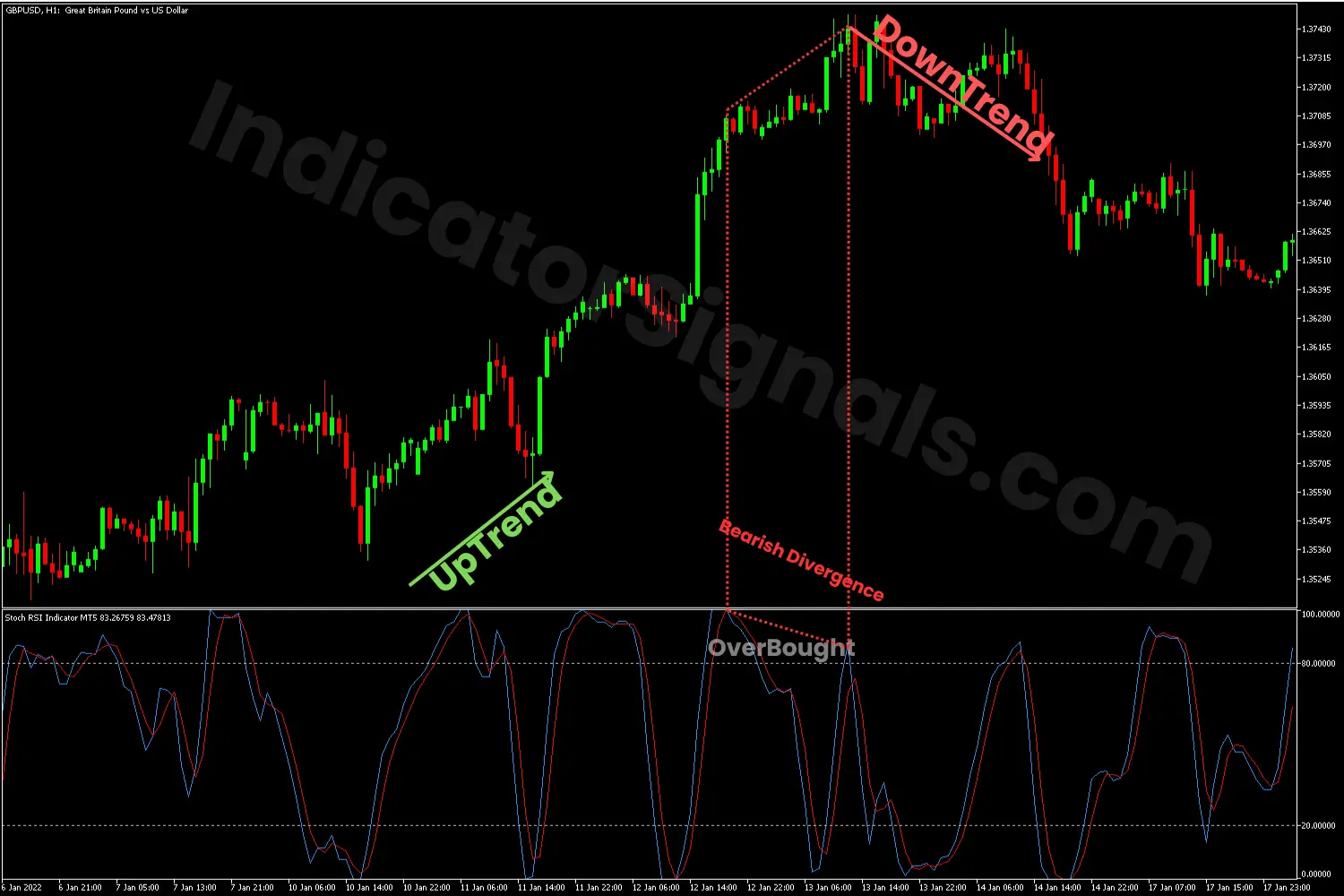

The Stoch RSI Indicator on MT4 is a technical analysis indicator that enhances price sensitivity by applying the Stochastic formula to the RSI itself. Also available on MetaTrader 5, this indicator oscillates between 0 and 100, with key levels at 20 and 80, helping traders identify overbought and oversold conditions and determine bullish and bearish divergences, making it useful for spotting potential reversals.

The Stoch RSI indicator is a momentum oscillator, ranging between 0 and 100 levels, designed to provide highly responsive momentum signals by combining the stochastic with the relative strength index indicator. Furthermore, this indicator consists of two lines:

- %K Line (Blue): The main Stoch RSI line fluctuates based on RSI movement.

- %D Line (Red): Moving Average of %K, helps to smooth out signals.

Based on these two lines and the four key levels of this indicator (0, 20, 80, and 100), traders can identify bullish or bearish signals by determining market conditions and potential divergences between the price movements and the indicator's line.

- Bullish Signal: Appeared when the %K line crosses above the %D line, especially under the following conditions:

- Oversold condition: When Stoh RSI drops below the 20 level and then starts moving upward.

- Bullish divergence: If the price makes lower lows and the indicator forms higher lows, that confirms a bullish reversal.

- Bearish Signal: Appeared when the %K line crosses below the %D, especially under the following conditions:

- Overbought condition: When the Stoch RSI rises above the 80 level and then begins moving downward.

- Bearish divergence: If the price forms higher highs and the indicator makes lower highs, that confirms a bearish reversal.

In the first trading example on an MT4 chart, during the downtrend, the Stoch RSI indicates sell signals whenever the red line crosses above the blue line and conversely for buy signals. But, at the trend's end, as shown in the screenshot, when the indicator enters the oversold zone and forms higher lows alongside the price making lower lows, suggesting a bullish divergence. At that moment, when the %K line moves above its moving average line, signaling a bullish reversal and a buying opportunity.

In the second trading example on an MT5 chart, during the uptrend, the Stoch RSI indicates buy signals whenever the blue line crosses above the red line and conversely for sell signals. But, at the trend's end, as shown in the screenshot, when the indicator enters the overbought zone and forms lower highs alongside the price making higher highs, suggesting a bearish divergence. At that moment, when the %K line moves below its moving average line, signaling a bearish reversal and a selling opportunity.

Before any trade decisions, based on this indicator, it is recommended to combine the Stoch Rsi with the other categories of technical analysis indicators, such as trend, patterns, or volume, to make informal entry and exit points.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.