Version:

1.0

Updated:

13 March 2025

Downloads:

1

The RSIOMA (RSI of Moving Averages) indicator on MetaTrader 4 is built by applying the RSI to a Moving Average, smoothing price movements and providing clearer trade signals. It consists of two main lines: the rsioma and signal lines. Available on the MT5 chart as well for FREE, this indicator helps traders identify trend direction signaling buying or selling opportunities and determine whether the market is oversold or overbought anticipating potential reversals.

The RSIOMA indicator is a trend-following technical analysis that combines the Relative Strength Index (RSI) and Moving Averages to identify market momentum. It displays on the MetaTrader chart two lines:

- The rsioma line (blue), where RSIOMA = 100 - 100 / (1 + RS)

- The signal line (purple), where S.L= MA (RSIOMA, M); M is the smoothing period of the S.L

In addition, the indicator consists of three levels, 20, 50, and 80 values, each offering valuable insights for trading strategies alongside the main lines:

- Potential trend reversals:

1. Overbought and Oversold Conditions:

- Oversold level (20-value): If the RSIOMA remains below this level, it suggests a potential oversold market. A bullish reversal is signaled when rsioma crosses above the signal line and the 20 level, presenting a buying opportunity.

- Overbought level (80-value): If the RSIOMA stays above this level, it indicates a potential overbought condition. A bearish reversal is signaled when the rsioma line crosses below its MA and the 80 level, providing a selling opportunity.

2. Divergences:

- Bullish divergence: If the price forms lower lows while the RSIOMA indicates higher lows, that suggests a potential reversal to an uptrend.

- Bearish divergence: If the price presents higher highs while the RSIOMA forms lower highs, that signals a potential reversal to a downtrend.

- Trend confirmation:

- When the indicator crosses above 50, confirms the upward trend and reinforces bullish momentum.

- When the indicator crosses below 50, validates the downward trend and signals bearish dominance.

Furthermore, the RSIOMA displays histogram bars at the bottom of the indicator's window, providing a quick visual representation of the current trend before making trade decisions. If a buy signal appears while the histogram shows red bars (bearish trend), traders should wait for confirmation to avoid false signals, and conversely for a sell signal alongside green bars.

In this section, I will present four trading examples to help our trader visitors understand how to use effectively the RSIOMA indicator in real market conditions.

1. In the first example on the MT4 chart, when the rsioma line crosses above the signal and the 20-value lines, signaling a long opportunity. The indicator rises and breaks through the 50 level, confirming the continuation of the trend. By entering the overbought condition, in this situation, traders should exit their long positions and wait to enter short. As the blue line crosses below the purple and the 80-value lines, and when the green bars appear, all of these conditions signal the beginning of the bearish movement and a selling opportunity.

2. In the second example on the MT5 chart, when the rsioma line crosses below the signal and the 80-value lines, signaling a short opportunity. The indicator drops and breaks through the 50 level, confirming the continuation of the trend. By entering the overbought condition, in this case, traders should exit their short positions and wait to enter long. As the blue line crosses above the purple and the 80-value lines, the appearance of the red bars doesn't confirm the buying opportunity. But when the green bars show up, it signals the beginning of the bullish movement.

3. In the third example on the MT4 chart, when the blue line crosses below the purple line, followed by a crossover below the overbought line as well, signaling a downward trend. Toward the trend's end, as shown on the chart, the price forms lower lows while the RSIOMA shows higher lows, suggesting a bullish divergence. When the indicator rises above the 20 level, that confirms the bullish reversal, signaling a buying opportunity.

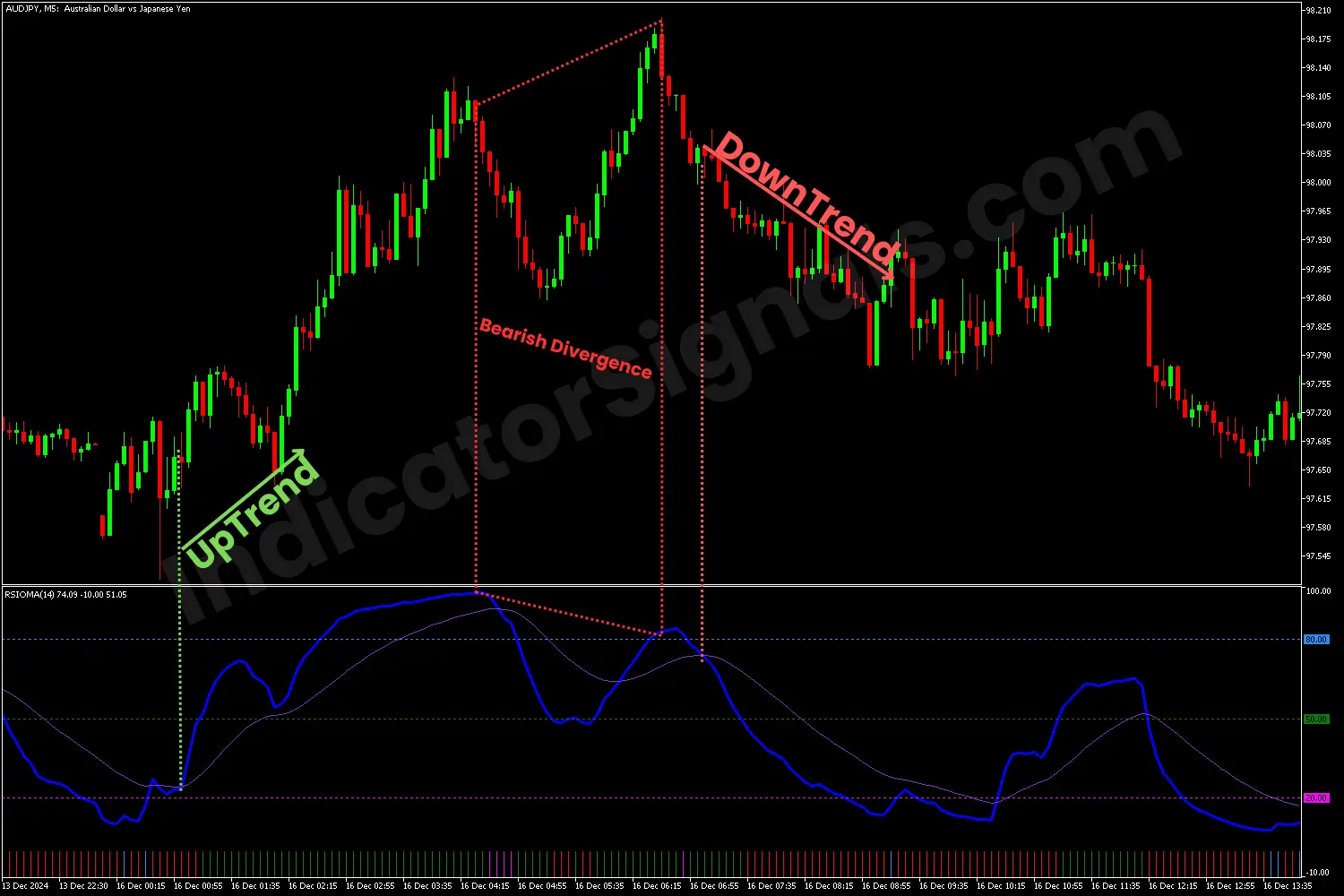

4. In the last example on the MT5 chart, when the rsioma line crosses below the signal line, followed by a crossover above the oversold line as well, signaling an upward trend. Toward the trend's end, the price forms higher highs while the RSIOMA shows lower highs, suggesting a bearish divergence. When the indicator falls below the 80 and the purple lines, that confirms the start of the bearish movement, signaling a selling opportunity.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.