Version:

1.0

Updated:

25 February 2025

Downloads:

11

Mastering risk management is as important as technical and fundamental analysis for becoming a profitable trader. The Risk Reward Box Indicator on MT4 is designed to help traders identify their risk-to-reward ratio (RRR) for any position, ensuring better trade planning and portfolio management. Applying this indicator on an MT5 chart helps traders also pinpoint their stop-loss and take-profit levels, adjusting to their preferred RRR (1:2, 1:3, or higher).

After exploring most of the technical analysis indicators available on our platform for FREE, traders should shift their focus to risk management, which is just as important as technical or fundamental analysis in trading. The Risk Reward Box Indicator is designed to simplify all of this, making it easier for traders to identify their risk-to-reward ratio.

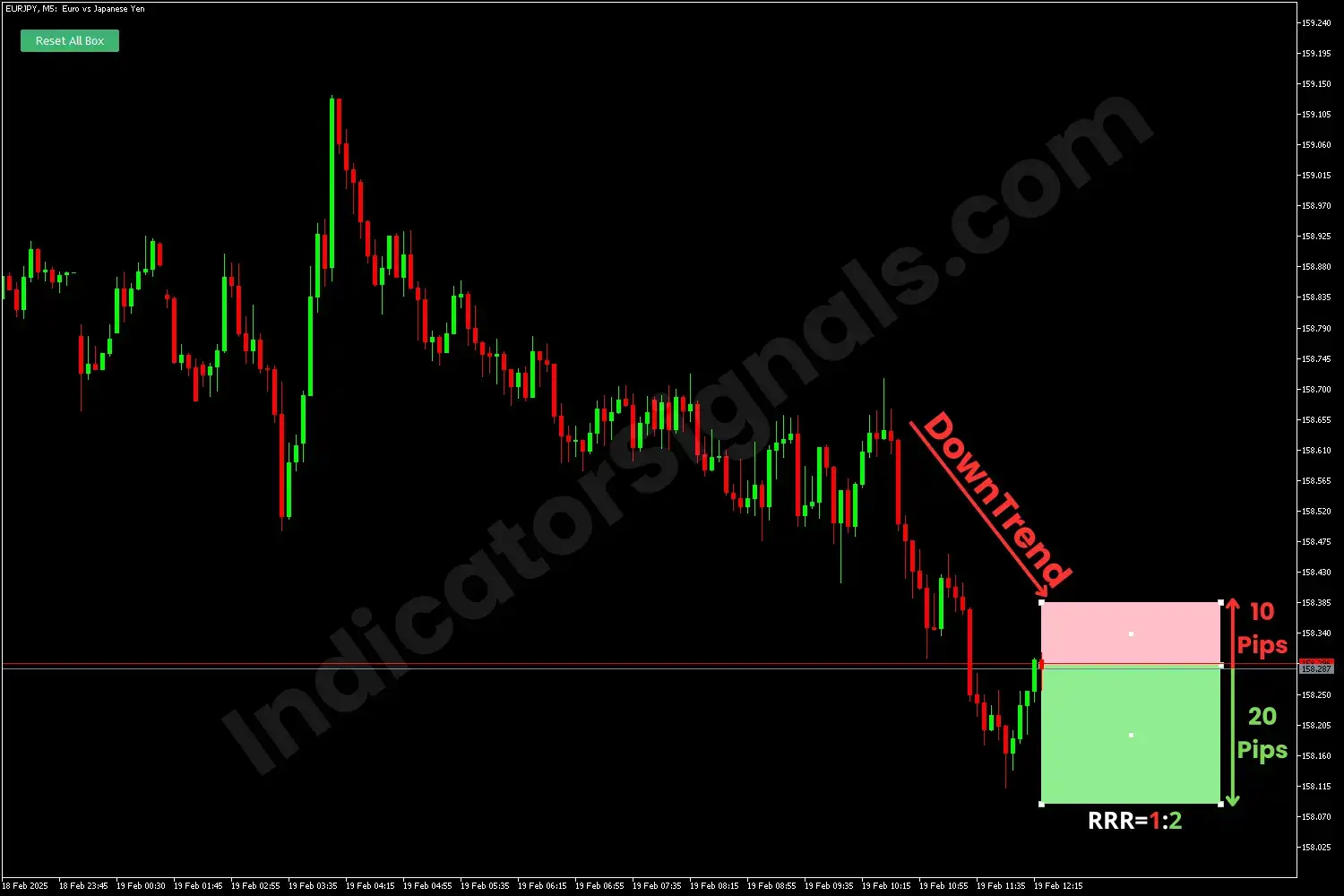

Furthermore, this indicator creates a rectangular box on the chart, highlighting trade components:

- Entry setup: The price at which the trade is placed.

- Stop-Loss (SL): The predefined price level where the trade will automatically close if the market moves against the trader, it will be adjusted by the red rectangle and moves up or down, responding to the type of the position (long or short).

- Take-Profit (TP): The price level where profits are secured, once reached, will be adjusted by the green rectangle and moves up or down, responding to the type of the position as well.

- Risk-to-Reward Ratio (RRR): The indicator displays the SL or TP in pips, enabling traders to calculate their RRR and adjust their trade setup to meet their preferred risk management strategy, such as 1:2, 1:3, or higher.

To stay consistently profitable, traders should respect their risk-management strategy, and to make that easy, they should apply this indicator before any trade entry.

Hypothetically, after identifying my entry setup for both long and short trades, I will apply the Risk Reward box indicator before executing a buy or sell order, respectively.

In the USDCHF chart example on MT4 (4h timeframe), I set my stop-loss price below my entry point with a 20-pip risk, entering long in this position during the uptrend. To respect my risk management strategy, I aim for a profit target of 3x my risk, resulting in a 1:3 RRR.

In the EURJPY chart example on MT5 (5M timeframe), I take a scalping trade in a short position during the downtrend, so I set my stop loss with a 10-pip ris,k, and my TP is twice the risk, which means 40 pips. Although I chose a 1:2 RRR in this position, it still ensures a reward higher than the risk, aligning with my risk-management strategy.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.