Version:

1.0

Updated:

07 March 2025

Downloads:

6

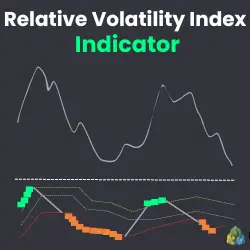

The Relative Volatility Index (RVI) is a technical analysis indicator on MT4, designed to measure market volatility while considering the direction of price movement. Available also on MetaTrader 5 for FREE, this indicator ranges between 0 and 100 levels, presenting a complex visual representation on the chart, helping traders determine optimal entry and exit points by identifying trend strength and direction and spotting potential reversals as well.

The RVI is classified as an oscillator indicator to gauge market volatility strength, developed by Donald Dorsey in 1993 as a variation of the RSI. While the last one measures the momentum price movement, the RVI focuses on the standard deviation of price movement, giving traders a clearer insight into high and low prices.

When the RVI is applied to the MetaTrader chart, it displays various line types, fills, and colors, allowing traders to filter out price noise and focus on the indicator to identify whatever they want, trend direction, strength, and even potential reversals with clarity.

- Trend direction and strength:

- If the RVI moves above the rvi level up (green dots line), making a green fill, signaling a strong bullish movement with high volatility.

- If the RVI drops below the rvi level down (red dots line), making an orange fill, indicating a strong bearish momentum with high volatility.

- If the RVI ranges between the red and green lines, making a silver fill, that signals a consolidation phase and low volatility in the market.

- Potential reversals:

- Bullish divergence: If the price forms lower lows while the RVI indicates higher lows, that suggests a potential reversal to an uptrend.

- Bearish divergence: If the price presents higher highs while the RVI forms lower highs, that signals a potential reversal to a downtrend.

To highlight, it is recommended to use RVI in combination with other indicators, such as MA or RSI, to confirm trade signals and avoid false ones.

In the USDJPY trading example on MT5, as shown on the chart, there is a consolidation phase at the beginning confirmed by the middle silver line and the silver fill as well. As the indicator moves above the level-up line indicating a strong bullish momentum alongside a high volatility market condition, presented by a green fill, that signals a strong buying opportunity and the price rises. For the downtrend, when the RVI drops below the level-down line and forms an orange fill, indicating a high volatility market condition and signaling a strong bearish movement and short opportunity.

In the GBPAUD trading example on MT4, toward the end of the downtrend, as shown on the chart, the price as usual forms lower lows but the RVI shows higher lows, suggesting a potential bullish reversal. As the indicator rises above the level-up line, confirming the start of the bullish momentum. Traders should exit their short positions and enter long in these kinds of market situations.

In the EURCHF trading example on MT5, toward the end of the uptrend, as shown on the chart, the price as usual forms higher highs but the RVI presents lower highs, suggesting a potential bearish reversal. As the indicator falls below the level-down line, confirming the start of the bearish momentum. Traders should exit their long positions and enter selling in this situation.

By mastering this indicator, traders can have a clearer insight into price movement by just following this indicator, but for more accuracy, before entering short or long in the market, they should confirm these signals by applying other categories of technical analysis indicators, such as trend, volume, or patterns, which are available for FREE on our platform.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.