Version:

1.0

Updated:

21 April 2025

Downloads:

0

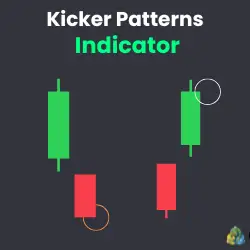

The Kicker Patterns Indicator for MetaTrader 5 is designed to automatically detect bullish and bearish kicker candlestick patterns, known for signaling potential market reversals. This indicator highlights entry points by analyzing candlestick gaps and shifts in momentum, helping traders capitalize on trend changes.

The Kicker Patterns Indicator is a specialized candlestick tool designed to identify bullish and bearish kicker candles, which are reversal signals in technical analysis. These patterns often occur after news or sentiment shifts and are marked by a significant candle in the opposite direction of the previous trend, with a noticeable price gap.

However, the indicator automatically marks bullish kicker formations with a white ring and bearish ones with an orange ring, making it easier for traders to identify potential entry points.

- Bullish Kicker Pattern:

- The first candle is red, reflecting the bearish sentiment in the market.

- The second cndle is green that opens with a significant gap above the previous candle's open and continues upward.

This pattern signals a sudden shift in market sentiment from bearish to bullish and gives a buying opportunity for the trader.

- Bearish Kicker pattern:

- The first candle is bullish, showing continued upward momentum.

- The second one is bearish that opens with a gap below the previous's open and continued to fall.

This pattern indicates a sudden chane in market direction, suggesting a short opportunity for the trader.

To avoid false signals and to confirm the change of market sentiment, it is highly recommended to combine this indicator alongside other categories of techncial analysis indicators, such as volume or oscillator, which are available for FREE on our platform.

1/ In the USDCHF chart example on MetaTrader 5, at the end of a prevailing bearish trend, the Kicker Patterns Indicator automatically detects and marks a white ring. This highlights the emergence of a bullish kicker pattern, which is a powerful reversal signal suggesting a sudden shift in market sentiment. In this particular case, the first candle is red, confirming ongoing selling pressure. However, the second candle opens with a significant upward gap above the open of the first candle and continues to move higher, forming a strong green bullish candle.

This formation reflects a decisive change, indicating that buyers have stepped in, possibly in response to new economic data, news, or a sentiment shift. As a result, traders are advised to consider closing any existing short positions to avoid potential losses from the reversal. Moreover, they may look for confirmation signals, such as volume spikes or supportive technical indicators, to initiate long positions, capitalizing on the newly established upward momentum.

2/ In the AUDNZD chart example on MetaTrader 5, the Kicker Patterns Indicator identifies a bearish kicker pattern by placing an orange ring near the top of an extended bullish trend. This alert draws attention to a potential market reversal. In this setup, the first candle is green, representing continued bullish strength. However, the following candle opens with a noticeable gap down, below the open of the previous candle, and pushes lower, forming a bearish candle.

This pattern is a classic sign of a sudden shift in sentiment from bullish to bearish, often triggered by unexpected news or market events. It suggests that the bulls have lost control and the bears are now dominating. Traders should close any long positions to secure profits or limit risk exposure. Simultaneously, the setup presents an opportunity to enter short trades, anticipating further downside movement as the reversal unfolds.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.