Version:

1.0

Updated:

20 March 2025

Downloads:

1

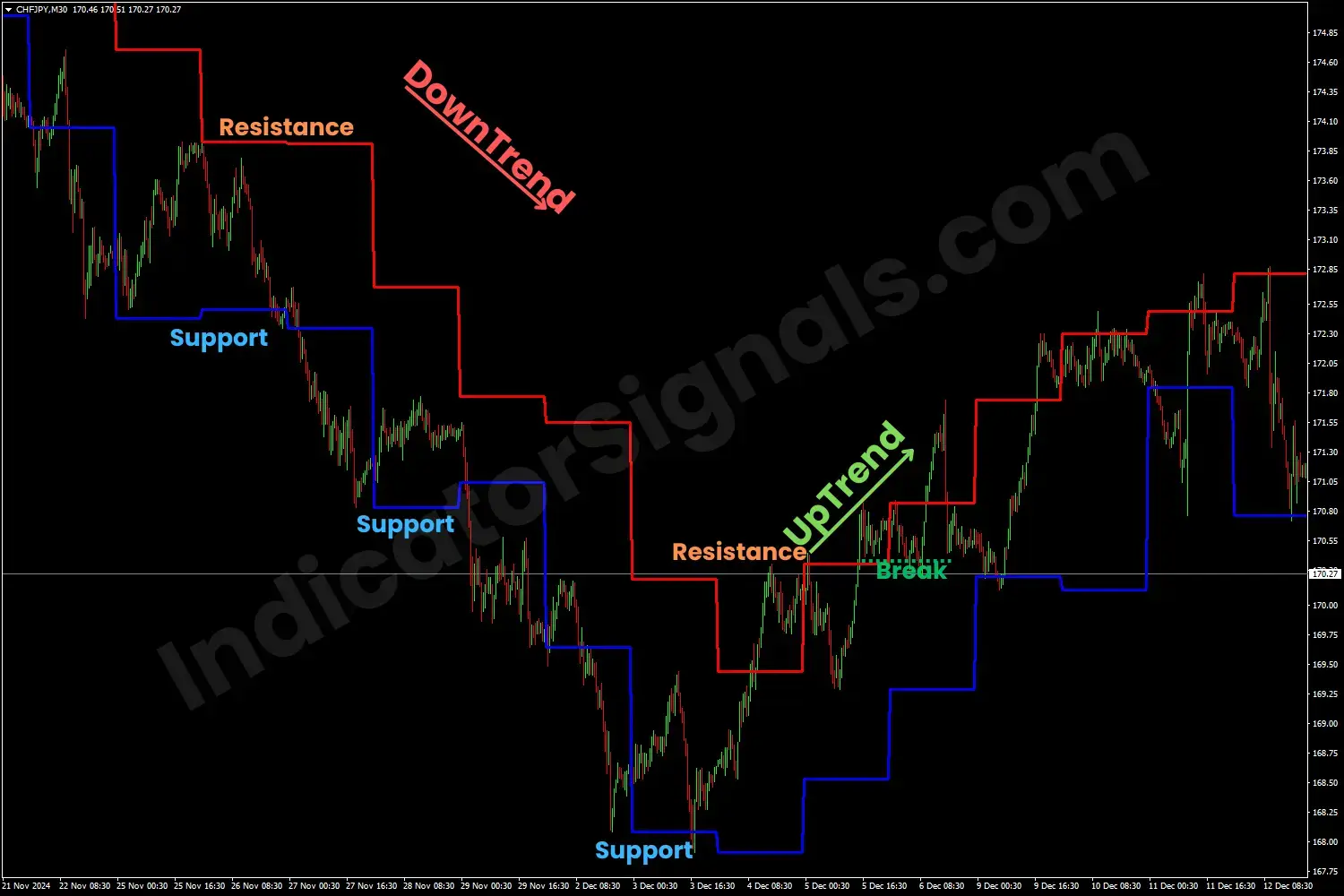

The Dynamic Support and Resistance (DS&R) indicator automatically displays support and resistance zones, on the MT5 chart, based on the previous price movements. Unlike static levels, these zones adjust dynamically, on the MetaTrader 4 platform as well, to reflect market conditions, helping traders identify trend direction, potential breakouts, and optimal entry and exit points.

The DS&R is a trend-following indicator that continuously adapts to price action. It plots dynamic support (lower blue) and resistance (upper blue) zones on the MetaTrader chart. These levels update in real time, providing traders with optimal trading setups.

Furthermore, the indicator enables traders to pinpoint key price levels where breakouts or reversal points are likely to occur, offering a clear visual representation to identify trend direction.

- Breakouts:

- During an uptrend, if the price breaks above the resistance level, signaling a continuation of the bullish movement.

- During a downtrend, if the price breaks below the support level, signaling a continuation of the bearish movement.

- Potential Reversal:

- When the price bounces from the resistance level and then breaks below the support level, that confirms the bearish reversal.

- When the price rebounds from the support level and then rises above the resistance level, that confirms the bullish reversal.

- Trend confirmation:

- During an upward trend, if the price rebounds from the support line, suggesting a buying opportunity.

- During a downward trend, if the price is rejected by the resistance line, signaling a selling opportunity.

1- In the GBPUSD trading example on MetaTrader 4, during the uptrend, when the price rebounds from the support level, indicates a potential buying opportunity, and when it rises above the resistance level, it confirms the continuation of the bullish movement.

Toward the trend's end, when the price failed to break the resistance line, and then dropped below the previous support line, signaling a bearish reversal and a short opportunity for the trader.

2- In the CHFJPY trading example on MetaTrader 5, during the downward trend, when the price rebounds from the resistance level, indicates a potential selling opportunity, and when it rises above the red line, it confirms the continuation of the bearish movement.

Near the trend's end, when the price failed to break the blue line, and then rose above the previous resistance line, signaling a bullish reversal and a long opportunity for the trader.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.