Version:

1.0

Updated:

25 February 2025

Downloads:

4

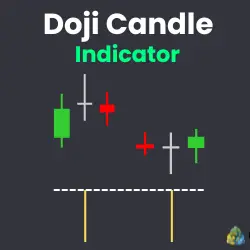

The Doji Candle Indicator is a technical tool used on MT4 to signal potential market reversals. It forms when the open and close prices are nearly identical, indicating market indecision. By using this indicator on MetaTrader 5 as well, traders can spot potential long or short opportunities and determine optimal exit points for their positions.

The Doji candle Indicator, classified as a pattern indicator, is a key reversal signal commonly used in technical analysis. It detects the doji when the opening and closing prices of a trading period are virtually the same, showing a cross or plus-shaped candlestick with small or no body and extended wicks on either side.

Furthermore, the doji indicates indecision in the market, as neither the buyers nor sellers are in control. This indicator can signal a reversal or continuation by detecting the Doji. At the end of an uptrend suggests a reversal to a downtrend, and vice versa at the end of a downtrend.

On the trading example on the metatrader 4 chart, an uptrend begins with a signal from the doji candle indicator that shows a doji on the chart signaling a long opportunity. Later, as the EURJPY chart reaches the end of the trend, another doji appears, indicating a potential reversal into a downtrend and providing a sell signal for traders. This signal provides the trader with an exit point for his position and gives him a profit of around 100 pips.

Similarly, on the trading example on the metatrader 5 chart, a downtrend starts with a signal from the doji candle indicator showing a doji candle on the chart pointing to a short opportunity. Toward the trend’s conclusion, a second doji emerges on the CADJPY chart, signaling a reversal into an uptrend and offering a buy signal for traders. With this signal, the trader can close his position and make a profit of around 85 pips.

IndicatorSignals.com - Owned & Operated By

FINANSYA LAB

|

2026 © All Rights Reserved.